Mid-Atlantic Businesses Face California-Sized Rate Increases After Electricity Market Shock

Rate increases incoming: Mid-Atlantic states will see double-digit rate increases as a result of unprecedented 10x price increase in the latest PJM capacity auction.

More turbulence ahead: Uncertainty looms, with auction prices expected to remain elevated and the market operator, utilities, and policymakers all searching for fixes.

Going long on energy: Microgrids enable businesses to “go long” on energy, locking in lower costs and maintaining the flexibility to adapt to changes on the grid.

It’s not often that the dull-sounding topic of a capacity market auction makes headlines, but this summer’s auction in PJM - the nation’s largest power market, with 65 million customers across 13 states and Washington, D.C. – sent shockwaves through the industry: the auction clearing price rose almost tenfold, resulting in over $10 billion in new costs for utilities in the region that will ultimately be borne by customers.

That means that eye-watering, California-sized annual rate increases of 10-20% or more are coming to businesses in mid-Atlantic states like New Jersey, Maryland, Pennsylvania, and Virginia. Moreover, there’s tremendous uncertainty surrounding how the market operator and policymakers will attempt to fix this issue, creating additional risks as radical approaches like re-regulation are considered.

Businesses looking to avoid the pain of higher costs and exposure to the risks of regulatory uncertainty have essentially one option – “going long” on energy with their own microgrid. Microgrids protect businesses from this “macrogrid” turbulence by optimizing multiple on-site resources like solar and battery storage to lock in lower energy costs, while maintaining flexibility to adapt to future rate shocks and regulatory changes.

To understand what’s happening in PJM, why it’s likely to continue, and why microgrids are the only near-term solution for most businesses, read on.

What happened in PJM – and why?

First, if you need an explainer on the capacity market, also known in PJM as the Reliability Pricing Model (RPM), the PJM website has terrific resources to help get your footing. But the short version is: in addition to buying enough electricity to meet today and tomorrow’s electricity demand in the energy market, utilities have to buy an additional “reserve margin” in the capacity market from resources that promise to be available during emergencies – e.g., during heatwaves when ACs ramp up, or during severe storms when portions of the grid go down. The capacity market essentially serves as an insurance policy to make sure there’s enough generation available during peak demand or emergencies, and the costs of this policy are passed onto customers.

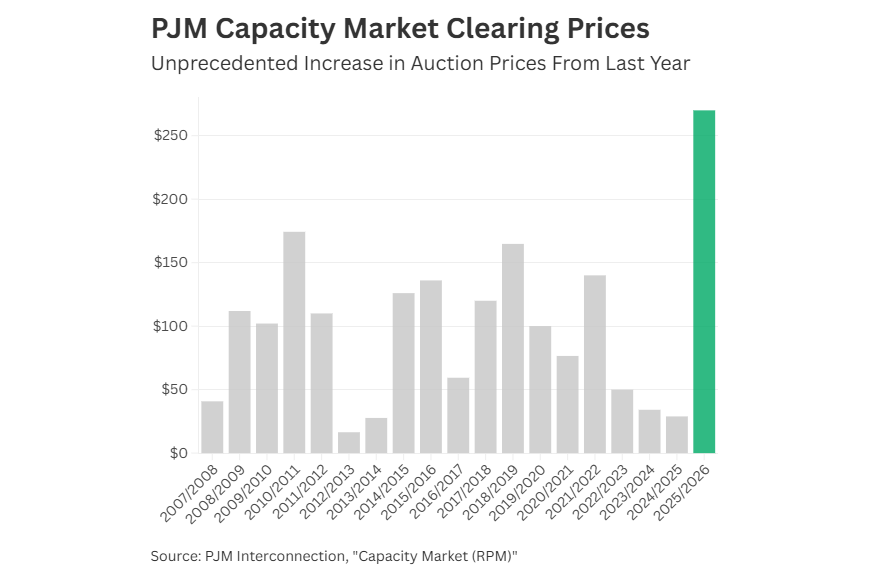

At the end of July, the latest annual capacity auction for PJM resulted in a clearing price of nearly $270/MW-day, a nearly tenfold increase compared to $29/MW-day the previous year – “a mind-boggling, staggeringly incomprehensible number” according to Steve Lieberman, vice president of transmission and regulatory affairs for American Municipal Power as quoted in UtilityDive. This translates into $14.7 billion in capacity costs that will be allocated to customers for 2025-2026, compared to just $2.2 billion in 2024-2025.

This massive spike in prices is due to a confluence of both supply and demand factors, some specific to PJM market rules and others due to long-term trends faced across the country. After 2022’s Winter Storm Elliott resulted in “unacceptably high” outage rates for natural gas power plants in particular, PJM changed calculations for resource capacity to be more conservative, reducing the amount of capacity available to bid into the market. At the same time, the market has seen 34 GW of aging coal plants close over the past decade because they are no longer competitive (in part due to more stringent emission control requirements), further shrinking the available capacity.

On the demand side, PJM has also increased the required capacity reserve margins that utilities must procure – a sensible response due not only to recent failures of natural gas generators in cold weather but to the more broadly growing risks of extreme weather due to climate change, which has made the grid more fragile and prone to outages that can also be caused by heatwaves and severe storms. Moreover, overall electricity demand in PJM is growing for the first time in years due to new data centers for the booming AI industry, new manufacturing facilities, and the electrification of heating and transportation.

The combination of this reduced supply and increased demand, due both to market rules and market fundamentals, drove the unprecedented squeeze in this year’s auction. To cover these costs, utilities are planning major rate increases; for example, Exelon is already estimating double-digit rate increases for some of its subsidiaries in the region. Scale has had recent discussions with industry stakeholders that believe the ultimate electricity bill increases could be 20% or more for some customers.

What’s next for PJM customers?

Unfortunately, this spike is almost certainly not a one-off event. Morgan Stanley estimates that market prices for the next auction – which PJM has proposed delaying in response to complaints from environmental groups – could be as high or even higher, potentially nearing the market cap of $700/MW-day. Thus, customers in PJM territory should be prepared for a second double-digit rate increase in the years ahead.

These elevated capacity market prices could also continue beyond the next auction, given daunting market fundamentals. Another 50 GW of fossil fuel plants are currently scheduled to retire by 2030, accelerating demand growth – from data centers in particular – could add 40 GW in demand over the same period, and new generating resources are stuck in interconnection queues that are also stretching out towards the end of the decade. As a market analyst from ESAI Power summarizes it, “we’re going to be in a higher-priced market for another few auctions, just because PJM doesn’t have a lot of surplus capacity anymore.”

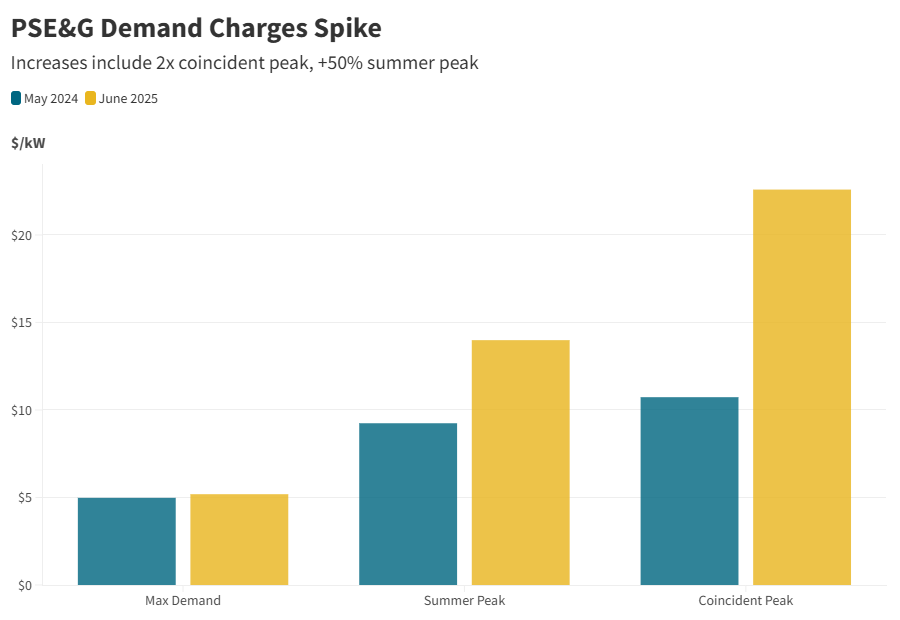

It’s widely recognized among utilities, policymakers, and PJM itself that this status quo of annual double-digit rate hikes will not be economically and politically sustainable over even the medium term. However, the path forward for reforming the market is far from clear. Since changes to market rules on capacity calculations are a primary driver of the cost increase, additional changes to the market will undoubtedly be considered, alongside likely increases to the capacity tags and demand charges paid by businesses based on their maximum demand at certain times of the year and from month-to-month.

Market supply shortages will also need to be addressed, however. Postponing retirements of aging coal plants may offer a temporary salve, but PJM’s long-term future will depend on increasing the supply of new generation. While an obvious remedy would be reforms to the interconnection process to fast-track approval of new generation, utilities in the region are also lobbying for re-regulation of the sector – in other words, reversing the restructured markets of the last 20 years and allowing utilities to build their own generation and charge the costs to customers.

It’s impossible to say what combination of remedies will be pursued and how effective they’ll be. However, it’s clear that this uncertainty translates into risk for customers – especially in the case of dramatic steps like re-regulation, which would reinstate a paradigm for grid development that was abandoned in most parts of the country in the late 1990s and early 2000s due to the inefficiencies and high costs of regulated monopolies.

Dodging Cost Increases and Navigating a Changing Market

When faced with utility rate increases in the past, business customers in competitive markets could typically turn to competitive retail suppliers to procure lower-cost energy supplies and hedge against future risks. But with this price spike impacting capacity costs, not energy costs, and thus likely translating into higher demand charges and capacity tags, most retail suppliers will see their costs increasing as well. As a result, businesses in competitive markets won’t be able to rely on these suppliers to escape the fast-rising costs of the coming years. Customers in vertically-integrated markets like Virginia and Tennessee will have even fewer options in the face of this unprecedented market volatility and uncertainty.

Instead, the best – and perhaps only – viable long-term strategy for many businesses will be reducing their reliance on the PJM grid altogether by building their own on-site distributed energy resources (DERs) like solar, batteries, and microgrids. Over the past decade, solar and battery costs have dropped by nearly 80%, and solar installations for commercial customers have nearly quadrupled, with the proportion of those installations with battery storage attached also expected to quadruple in the coming years.

While basic solar and solar-and-storage installations can offer some insulation from PJM’s price surge, the most robust insurance is a microgrid designed and operated by third-party experts like Scale. Microgrids combine the advantages of each DER to provide a single integrated, optimized energy resource, and Scale ensures that their operations maximize cost savings based on specific utility rate structures and a given facility’s energy use. Crucially, this includes the ability to minimize demand and capacity tag charges – which can account for over 40% of electricity bills (and likely more in the coming years) – by relying on the microgrid instead of the utility grid during times when these charges are calculated, thus reducing bills without impacting facility operations.

Microgrids can also keep power supply going when the grid goes down, providing incredibly valuable resilience in the face of the rising climate risks that helped cause this capacity price spike in the first place.

Finally, against this backdrop of market turbulence, having the expertise of a company like Scale to continuously optimize (and re-optimize) the operations of microgrid resources ensures that you stay on top of sudden market changes. For example, when some of our California customers saw potential solar savings undercut by changing compensation under the NEM 3.0 regulation, Scale was able to adjust the dispatch of their battery storage resources to maximize on-site use of solar during peak hours of demand – a win-win for customers as well as the grid.

Having a microgrid optimized and operated by an industry leader like Scale gives you the on-site assets you need to weather the coming storm in electricity prices, along with Scale’s expert asset management team to ensure that you successfully navigate whatever market turbulence lies ahead. And, with a $0 down microgrid service agreement (MSA) from Scale, which typically lets you realize utility bill savings from day one, you don’t even need to make a major capital investment to “go long” on energy amidst the ongoing PJM chaos.

Reach out to ahughes@scalemicrogrids.com to learn more about how Scale can help your company manage rising PJM energy costs and risks.

Giving you the

power to grow.

Our team is ready to help you take charge of your energy with solutions designed to meet your needs.